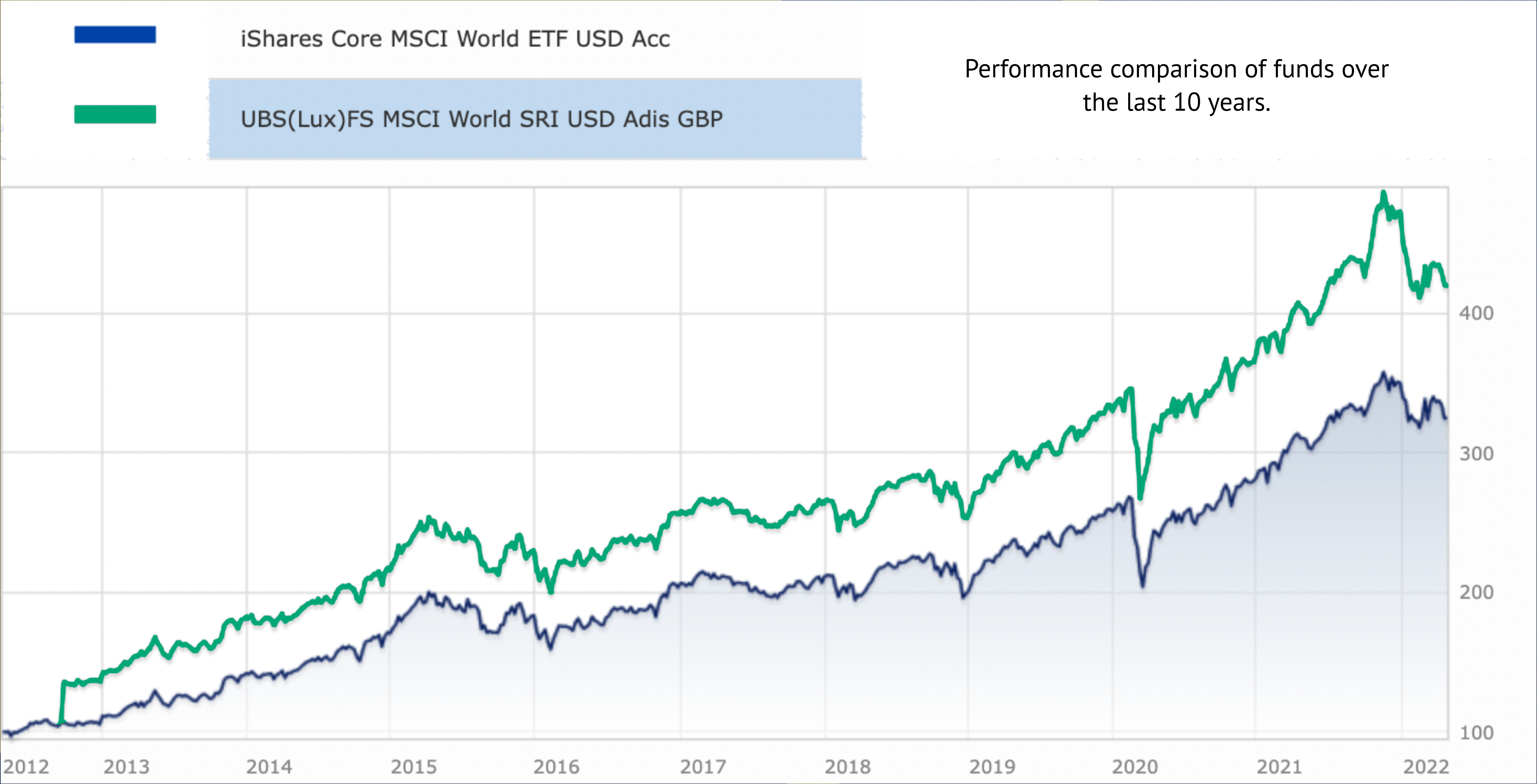

Below you can see a comparison of 2 funds focused on global equities. One fund invests in all standard global companies, the other contains only socially responsible ones. You can see from the comparison that the socially responsible companies do even better than the standard ones. So investing in socially responsible companies is not a trade-off between return and a good thing.

Note: Comparison is in CZK currency

Source: morningstar.com

Funds ISIN: IE00B4L5Y983, LU0950674332

How environmental, social and governance factors affect the performance of a particular investment. It does not address much the subject of the business.

E - ENVIRONMENTAL - These criteria take into account how companies deal with waste, energy, emissions, water consumption and other factors tied to the environment.

S - SOCIAL - these criteria examine how the company treats its employees, what conditions it creates for them in the workplace, how it helps them with their education, and also how the company treats its customers.

G - GOVERNANCE - or corporate governance criteria look at the management of the company, executive pay, audits, internal controls and shareholder rights. This includes transparent accounting.

Socially responsible investing = investing in line with our values

A stricter filter where the subject matter of the business and its impacts are additionally addressed. Companies from problem sectors are excluded - e.g. the tobacco or arms industries - but shares in companies that have committed in their articles of association to operating in line with socially responsible business principles, contributing to environmental improvement or helping to solve social problems are selected.

SRI is a type of investment that is mindful of the environmental and social impacts of investments

Investing with an impact on society and the environment

Focusing on investments in companies and projects that intend to create a measurable positive social or environmental impact - along with a financial return. For example: General Electric.